VAT registration details - what you need to know

Or call us

☎ 020 8810 4500 ![]()

I look forward to hearing from you

Vic Woodhouse

20A The Mall

Ealing

London

W5 2PJ

Ealing

London

W5 2PJ

- VAT registration compulsory

- The current compulsory VAT registration threshold figure from is Sales, taxable supplies, in excess of in any twelve month period.

- Previously VAT registration threshold figure from 1 April 2018, until 31 March 2024, is Sales, taxable supplies, in excess of £85,000 in any twelve month period.

- Export sales are zero rated and must be included in Sales.

- You disregard sales which are:

- Outside the scope of VAT.

- Exempt VAT.

- So sales Outside the scope of VAT and exempt VAT will not themselves trigger compulsory VAT registration.

- Outside the scope of VAT and exempt VAT are different from each other and also different from zero rated VAT.

- You do not ignore zero rated.

- If you purchase services from EU suppliers; UK Brexit transition ended 31- December-2020

- You need to include purchase of services from EU suppliers under Reverse charge VAT for services from other EU countries regulations.

- The effect of the reverse charge is that a taxable supply is deemed to be made by the recipient of the service in the UK.

- More simply expressed, these purchases of services are treated as your sales.

- Date of VAT registration:

- If you exceed the annual total sales threshold this month, the date of VAT compulsory registration date will be the first of the month after next.

- You can apply for VAT exemption, exemption from VAT registration, if most of your sales are zero rated.

- You can still apply for an earlier date of VAT registration within the last four years.

- Change of ownership:

- If you purchase a business with past sales in excess of £ per year this will be a compulsory VAT registration.

- You can apply, together with the other party, to transfer the old VAT number to a new business owner but you must also submit a new application to register for VAT.

- You may be changing your own self employed, sole trader, business into a limited company in which case you apply as both parties.

- If you take over share ownership of a VAT registered limited company there will be no change of ownership for VAT purposes. You carry on with the same VAT number.

- Late filing of VAT returns or late payment of VAT will result in penalties and interest.

- Penalties are on an increasing percentage basis for repeated lateness; from 2% to 15% of VAT payable.

- If you apply for registration after the compulsory VAT registration date there could be an accumulation of interest and penalties.

- HM Revenue & Customs routinely check that compulsory registration for VAT has been applied from the correct date.

- If you are in any doubt about this please let us have your up to date:

- Sales invoice data.

- Bank statements.

- From the start of the business;

- or from whenever you know that you were below the limit.

- The compulsory VAT registration threshold figure was less in previous years.

- e.g. .

- Do this now; you should not wait until annual accounts are prepared.

- The threshold applies to ANY ANY ANY twelve month period not just once at year end.

- HMRC Guidance

2.3 Taxable supplies

A taxable supply is any supply made in the UK which is not exempt from VAT. Taxable supplies include those which are zero-rated for VAT.

A supply which is not VAT-exempt is always a taxable supply whether or not the person making it is registered for VAT.

...

2.4 Zero-rated supplies

Zero-rated supplies are taxable supplies on which the current VAT rate is 0%

...

exported goods ...- Our comment: An exported Sale is a zero rated Sale

made in the UK

.

- Going over the threshold temporarily

You can apply for a VAT registration exception - If your taxable turnover goes over the threshold temporarily and

- You believe your VAT taxable turnover won't go over the de-registration threshold of in the next 12 months

- You still need to complete a Form VAT 1 Value Added Tax (VAT) Application for registration.

- HMRC will consider your 'exception' and

- Write confirming if you get a VAT registration exception.

- If HMRC do not accept you for VAT registration exception, they'll register you for VAT.

- Most sales are zero rated - typically exports outside the EU

You can apply for a VAT registration exception if ALL THREE: - All or most of your taxable sales are zero-rated.

- And you can demonstrate that you would normally be a net reclaimant of VAT.

- And you apply and are accepted by HMRC for VAT registration exception.

- Then:

- You use the normal form VAT1C VAT Registration Notification.

- Or we can do this for you online.

- If HMRC do not accept you for VAT registration exception, they'll register you for VAT.

- As a precentage of VAT due:

- Not more than 9 months late 5%

- 9 months to 18 months late 10%

- More than 18 months late. 15%

- Minimum penalty of £50.

- If you supply from outside EU to UK, typically by internet sales, you need to register from the date of the first sale in UK under Non-established taxable person NETP VAT regulations.

- Only UK non VAT registered traders have a threshold of trading below which they do not need to register for UK VAT.

- You need to have a marketing strategy which enables you to sell in UK and pay the 20% VAT.

- In addition, banking practice may make it difficult for you to open a UK bank company account as a non UK resident director.

- Please talk to us about online banks which may facilitate opening a UK company bank account when directors are non UK resident.

- Trying to establish an apparent UK residency for trading purpose is probably fraudulent because it evades UK VAT.

- Registering and trading as a UK company will mean that you are not eligible for Non-established taxable person NETP VAT regulations because a UK company is established in UK.

- But - you will also probably not be able to register under normal procedures because you will not have a valid UK trading address.

- Attributes of a UK trading address:

- A valid UK address which is not a virtual office or your accountants office and

- Someone from the business is routinely at that address throughout the year and

- Control of the business takes place at that address and

- Records of the business will be available at the address for H M Revenue & Customs inspection.

- As a Non-established taxable person NETP you need to:

- Register for VAT using the standard registration form VAT1; available as a pdf or complete online.

- You need to provide copies of photo ID, copies of home address documentation and copy documentation linked to you country's official records.

- and appoint either:

- an agent, such as ourselves, who prepares appropriate accounting records and files VAT returns on your behalf.

- A representitive such as an employee to act for VAT on your behalf in UK. The representitive is legally responsible for paying VAT.

- and send a copy of the appointment to HM Revenue & Customs - VAT.

Please contact us if you wish us to act as agent for NETP VAT.

Read more

About Copy IDRead more

About appointing us as your agent for VAT

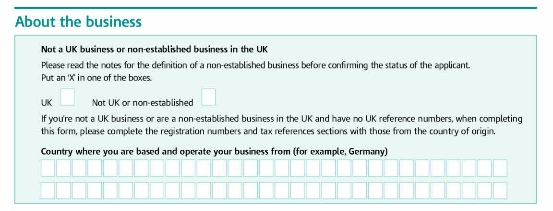

About the Business - Extract from form VAT1

Value Added Tax (VAT) Application for registration

- Typically applies to internet sales of goods but not services.

- If you are:

- A trader of goods.

- VAT registered in an EU country outside UK.

- You must register in UK when your sales into UK exceed £70,000.

- In any twelve month period.

- Applies to sales of services to non VAT registered customers in UK.

- Because of the reverse charge regulations for services, the UK non VAT registered customer needs to add services purchased from other EU countries to their sales in order to determine whether they should be UK VAT registered under VAT: compulsory VAT registration. See above .

- The EU trader only has to comply with the VAT regulations in his own country.

- VAT registration voluntary

- You may apply for voluntary VAT registration at anytime before reaching the threshold limit.

- If all of your sales are exempt VAT you will not be able to apply for VAT registration.

- If some of your sales are exempt VAT, you can register for VAT but VAT on costs attributable to exempt VAT sales cannot be claimed; some VAT on costs will need to be claimed pro-rata.

- Paying voluntary VAT is beneficial if all of your customers are VAT registered. You can claim VAT applicable to your costs.

- The downside is that you need to do quarterly VAT returns.

- Voluntary registration for VAT may be beneficial to apply for the flat rate scheme in which you collect on your sales and pay to H M Revenue & Customs at a lower rate on sales but do not claim actual VAT on purchases except assets costing over for which VAT may still be claimed.

How to do compulsory VAT registration or voluntary VAT registration.

To Register for VAT you need:

- Trading address - see attributes of a UK trading address above.

- A virtual office will not be accepted as a trading address.

- Actual or expected date of starting to trade.

- If you are intending to trade from serviced offices this may cause HM Revenue & Customs to scrutinize the application more carefully.

- Evidence of trading: if you have not made any sales at the date of application you may need to show evidence of intention to trade such as purchases, orders, premises lease etc.

- Details of your business bank account.

- Business bank account details can be provided after registration but VAT repayments go to the business bank account and are most likely on the first VAT return.

See our guidance on how to complete Your first VAT return

- Cancel your VAT registration

- If you are continuing to trade as unregistered after deregistration:

- You must have been VAT registered for one year.

- You need to believe and declare that your VAT taxable turnover won't go over the de-registration threshold of in the following 12 months.

- You decided whether you want to deregister.

- There is an online deregistration procedure or Complete form VAT 7 Application to cancel your VAT Registration.

- Form VAT 7 needs to be sent by post.

- HM Revenue & Customs then either confirm the date which you have chosen or provide an alternative date.

- A “Final” VAT return is set up by HM Revenue & Customs for completion, online, up to the final date of deregistration.

- You need to enter on the final return:

- Usual trading information - Sales and Purchases.

- Details of anything on hand at the date of deregistration on which VAT has been claimed.

- Typically this is the valuation at deregistration date of:

- Trading stock.

- Commercial vehicles.

- Computer and other equipment.

- You include these in the final VAT return as saies at valuation with VAT added.

- You charge yourself the VAT on these items as being 'sold' to yourself.

Our Ealing VAT specialists simplify the registration and filing process for your business.