Paying HMRC Self Assessment Tax

- by cheque, with or without a pay slip or electronically online payment;

K identifies tax paid as self assessment personal tax. The over-the-telephone service was discontinued some time ago.

Or call us

☎ 020 8810 4500 ![]()

I look forward to hearing from you

Vic Woodhouse

Ealing

London

W5 2PJ

Pay self assessment tax online

To go into HMRC Worldpay:

Four things before you start:

You don't need to wait for a statement from HM Revenue & Taxes.

1. Get your debit card.

2. Get your ten-figure UTR unique taxpayer reference from your tax correspondence or from last year.

3. Get your tax calculation.

4. Be clear what amount of tax you need to pay now.

You don't even need to have filed your tax return.

Self Assessment Payment Helpline

- Telephone: 0300 200 3822

- Tax liabilities under £30,000.

- Once you have filed your tax return.

- You can set up a payment plan to spread the cost of your latest Self Assessment bill.

- If you have a Government Gateway you can do this online

- Government Gateway user ID and password Guidance on applying

- Tax liabilities over £30,000.

- Telephone: 0300 200 3835

- Apply for a Government Gateway

- You first enter your email address.

- You get back a confirmation code which you use to move forward with the application.

- Have available:

- Unique Taxpayer Reference UTR - if you have one.

- National Insurance number.

- Driving license or passport details to link you into other Government records.

- There are various security checking options; you have to choose two. The driving license and passport options are the most straight-forward.

- Telephone number.

- You need to be ready to receive text or email security numbers from HMRC.

- Apply: "Create sign in details" on the Sign in screen.

- You get a Government Gateway number.

- Set the Password.

- You are then ready to use the Government Gateway

- and set up a payment plan.

Paying self assessment

Unless you have made specific alternative arrangements you need to pay any Self Assessment tax due on 31st January and 31st July. Daily interest is charged after the personal tax scheduled payment dates. Any interest paid may be an allowable expense in your self employed sole trader or partnership accounts but penalties are not allowable.

If you need time to pay see Time to pay tax.

There will be a 5% penalty on

personal tax paid later than . Tax should be paid even if you do not receive a statement or even if the return has not been filed. Interest will be charged on all personal tax and penalties, due under Self Assessment, paid later than normal due dates.

Self Assessment Personal tax late payment penalties extended tax year 2010/11 onwards

Also applicable to late payment of Student Loan repayments when these are calculated and paid through self assessment

- Extension of penalties:

- Tax for paid later than February 5% of tax.

- Tax for paid after 31st July another 5% of tax.

- Tax for paid after the next 31st January another 5% of tax.

- Total 15% of tax.

Late filing penalties are separate from late payment penalties

Read more

about Late filing penalties

Methods of making personal tax payment to hmrc:

Self Assessment payment of personal tax the traditional way

Paying tax by cheque to HMRC with the January and July tax payment slip

Send a cheque with the preprinted payslip in the preprinted envelope. Write your ten figure UTR Unique Taxpayer Reference, as payment reference, adding a K at the end, on the back of the HMRC cheque.

Preprinted pay slips my also be used for paying across bank counters, allow three working days.

You can no longer pay over Post Office counters. This facility was discontinued 15th December 2017.

HMRC Banking details shown on preprinted pay slips should not be used for electronic online payments. See details below.

If you have no personal tax pay slip from HMRC

If you wish to pay by post but do not have a preprinted payslip, write a note explaining:

That you are paying Tax under Self Assessment

Quoting your personal tax ten figure UTR Unique Taxpayer Reference , adding a K at the end.

Cheque HMRC: Write your UTR Unique Taxpayer Reference on the back of the cheque, adding a K at the end,

Where to send your tax cheque:

Send this to HMRC Non-geographic post code:

HMRC

Direct

BX5 5BD

What is a Non-geographic post code? Check with Wikipedia

Print out a payment slip:

There is also the HMRC Self Assessment payment slip to print out and send by post.

Preprinted personal tax paperwork is mailed to your home address by HM Revenue & Customs.

If your address has changed this will not be picked up by HM Revenue & Customs unless you, or your accountant, have notified your Self Assessment Tax office.

Perpetual reorganization of Tax offices may mean that changes have not been implemented even if you have told them.

A change of address may not be picked up from your Self Assessment Tax return.

Paying Tax due under Self Assessment on your debit card by telephone - Service discontinued

for debit cards electronically online and credit cards see below

Self Assessment Tax personal tax

You should always quote your ten figure personal tax UTR Unique Taxpayer Reference without gaps and adding a K at the end.

Payments need to be directed to either HMRC Cumbernauld or HMRC Shipley except for Worldpay see below one of which will be your allocated pay office. Neither of these is your personal tax office for Self Assessment Tax purposes. The HMRC Shipley or Cumbernauld problem is also applicable to Corporation Tax and PAYE/CIS

To establish whether your pay office is either Cumbernauld or Shipley you need to check your paperwork. If this is not possible HMRC ask for payments to be made to Cumbernauld. There is no penalty for paying the wrong office and you can expect your funds to be correctly allocated if you provide the right reference number.

If you are able to contact your Self Assessment Tax office they should be able to tell you but low service capacity can make telephone contact extremely difficult.

HMRC's online electronic bank account details for Self Assessment Personal tax

- if you are a self employed sole trader the same as for PAYE NIC and CIS

Cumbernauld Accounts Office references

HMRC bank: Sort code: 08 32 10

Account number: 12001039

Account name: HMRC Cumbernauld

Payments from abroad quote:

International Bank Account Number (IBAN) GB74CITI08321012001039

SWIFT Bank Identifier Code (BIC): CITIGB2L

Shipley Accounts Office references

HMRC bank: Sort code: 08 32 10

Account number: 12001020

Account name: HMRC Shipley

Payments from abroad quote:

International Bank Account Number (IBAN) GB05CITI08321012001020

SWIFT Bank Identifier Code (BIC): CITIGB2L

Paying Self Assessment Tax by internet, telephone banking or BACS Direct Credit

Normally takes three bank working days for payment to reach HMRC

Worldpay:

Paying Self Assessment Tax by debit card or credit card over the internet

(American Express Amex or Diners Club are not accepted)

No credit cards are accepted after 13th January 2018

The payment accounts office Cumbernauld or Shipley is not specified using this method

Pay HMRC by debit card - no charge.

Credit card payments are subject to a non-refundable transaction fee according to the card used.

Worldpay it is counted as paid the same day; although the bank processing time could be three to five days.

The HMRC Help Line telephone number has been discontinued.

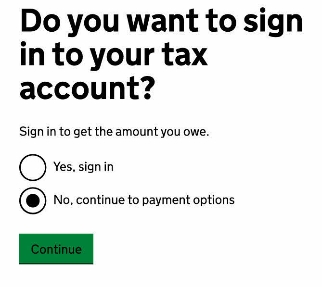

To go into HMRC Worldpay: https://www.tax.service.gov.uk/pay-online/self-assessment

Just enter your UTR unique taxpayer reference:

Ten figures

With “K” at the end for self assessment

The amount £

Then go through the card procedure like any other online payment.

Paying Self Assessment Tax by CHAPS transfer

Pay tax by bank transfer

Same day provided you initiate payment within the time specified by your bank, usually between 9.00 am and 3.00 pm.

By Direct Debit - ad hoc basis

If your cash-flow is sufficiently robust you can pay by direct debit. Find out how at https://www.gov.uk/pay-self-assessment-tax-bill/direct-debit

Budget payment plan - You can also use this method to make regular payments in advance of the tax liability falling due.

The HMRC Help Line telephone number has been discontinued:

For if you need both time to pay an existing liability and wish to progress onto making regular payments in advance.

Access the advance payment service throught the Direct Debit set-up procedure when you are up to date with previous payments.

On account payments

- Normally payable when tax on untaxed income exceeds £1,000 per year

- Payments on account Payable:

- for Tax year 2018/19:

- 31st January 2019.

- 31st July 2019.

- for Tax year 2019/20:

- 31st January 2020.

- 31st July 2020.

- No penalties for late payment but daily interest is charged.

- Mathmatical basis of calculation; two amounts of 50% of the prior year repeating liability.

- Claim to reduce these amounts if you think the figure is too high.

- But arrears of interest will be charged if you go below what turns out to be the actual liability.

- File the 2019/20 tax return before 31st July 2020 to be sure you are paying the right amount of tax.

Time to pay:

HMRC Business Payment Support Service Help Line 0300 200 3835

Payment plan

There is a formal initiative and time to pay helpline for businesses who anticipate needing time to pay. By entering into a time to pay agreement in advance of the due date for VAT and income tax, and adhering to the terms of the agreement, you can avoid VAT late payments penalties and income tax late payment penalties .

You then need to contest and appeal any notices you should subsequently receive. Time to Pay arrangement are often not advised to other parts of HMRC. Ignoring subsequent notices can result in bailiff action.

The scheme started November 2008 and by the end of June 2011: 444,400 proposals were agreed (95% of proposals) and 23,300 were refused. It is estimated that 87% of tax agreed under these arrangements had been paid by June 2011; being £6.7 billion.

It was announced in July 2011 that no further statistics will be issued but "There are no plans to close the Business Payment Support Service or change HMRC's Time to Pay policy or approach".

Tax losses

You can carry tax losses back into previous years.

If you are incurring tax losses in the current year these can be taken into account in Business Payment Support arrangements in respect of overdue and unpaid profit taxes.

You need reliable accounting records to demonstrate this to HMRC.